Taking extra time and effort to obtain the best deal for anything which involves a large expenditure is crucial, especially a personal loan.

Let’s use a S$20,000 loan as an example. Cheap Interest Loan A charges you 2% p.a. for it. On the other hand, Regular Personal Loan B charges you 3% p.a. You instantly save S$200 in the first year just by picking the cheap interest personal loan over a “regular” solution.

Obtaining a cheap loan in Singapore seems daunting, but we’ll show you what to look out for when comparing different products, and what cheap loan options are available in the Lion City.

How Does a Personal Loan’s Interest Rate Work?

Before you start comparing cheap loans in Singapore, you need to know what the different interest rates are and what they mean. You can then identify the cheapest loans better and make more informed borrowing decisions. This is regardless of whether you’re obtaining a cheap loan from a bank or licensed money lender.

Advertised Interest Rate

This is the headline interest rate on a loan’s advertisement. It’s the lowest cost possible for the loan, excluding all fees and assuming the borrower has an excellent credit score. When you’re comparing cheap loans in Singapore, you need to take into account not just the advertised interest rate, but the effective interest rate (EIR) as well. More on that next.

Effective Interest Rate (EIR)

On the other hand, the EIR represents the total and true cost of your cheap loan. It takes into account all fees, and that the loan’s flat interest rate is applied throughout the entire tenure and principal amount (not a reducing balance). For a true indication of whether a product is indeed the cheapest loan, compare both their EIRs and advertised interest rates. The higher your EIR, the more interest you’ll have to fork out.

Flat Interest Rate

A flat interest rate is what most of us would be familiar with. It’s a uniform percentage applied to your principal loan amount instead of the outstanding balance after every repayment is made. This influences your loan’s EIR too, increasing it as your loan tenure goes up as the number of compounding periods increases. To keep the cost of your cheap loan down, try to keep your tenure shorter as much as possible.

Revolving Interest Rate

This interest rate is only applied to credit facilities which allow you to borrow money as and when you need to, the opposite of how a typical cheap loan functions. For example, a line of credit. Although interest is only charged on the credit facility’s outstanding balance, the rates are usually hefty. Therefore, credit facilities are usually not considered as cheap loans.

FYI: 0% Interest Personal Loans

Loans advertised as having a 0% p.a. interest rate do exist, but you will need to pay a larger upfront processing fee for it. This fee then becomes your loan’s “interest rate”. Therefore, a 0% interest personal loan might not be the cheapest loan in Singapore if the upfront processing fee results in a relatively large EIR.

Comparing Cheap Interest Loans From Banks in Singapore

1. DBS Personal Loan

DBS — one of the most renowned banks in Singapore offers a cheap interest loan which starts as low as 1.9% p.a, which is considered one of the lowest rates possible out there! Though there is a 1% processing fee, it’s still considered pretty affordable; especially if you consider the flexible and cost-effective monthly repayments ranging from 6 months to 5 years. Additionally, you’re allowed to borrow up to 10 times your annual income if your yearly salary is at least S$120,000.

2. UOB Personal Loan

If you’re a UOB customer, you’d appreciate the UOB Personal Loan’s instant approval and disbursement. Interest rates may start at 2.88% p.a., but the bank is currently waiving processing fees for every tenure, regardless of whether you select the shortest or longest one. This puts the UOB Personal Loan in contention for the cheapest loan in Singapore.

3. OCBC ExtraCash Loan

The OCBC ExtraCash Loan is a cheap loan in Singapore which lets you borrow up to six times your monthly income if your annual salary is $120,000 and above. Loan tenures are standard, ranging from one to five years. However, the OCBC ExtraCash Loan’s interest rates are around 5.54% p.a. Therefore, it might not be one of Singapore’s cheapest loans. That being said, it may still be worth the consideration if the flexible borrowing limit is what you’re looking at.

4. Citi Quick Cash

This cheap interest loan from Citi requires you to be an existing customer of the bank. However, it does not charge any processing fee for its Quick Cash Loan. Furthermore, you don’t need to provide any supporting documents when you’re applying as you’re already Citi’s customer. Lastly, interest rates for this cheap loan start at 3.45% p.a.

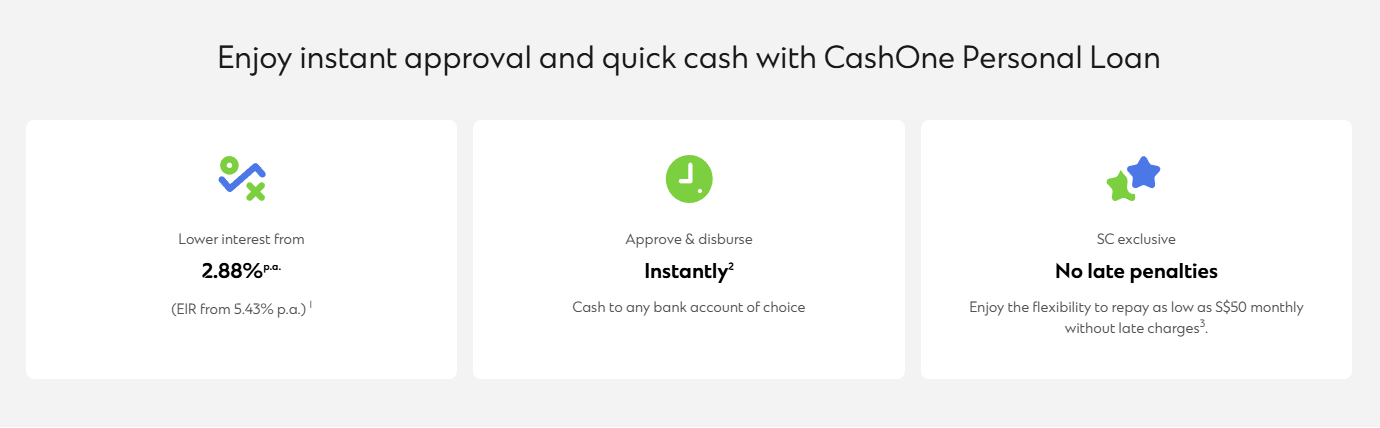

5. Standard Chartered CashOne Personal Loan

One standout feature of this cheap loan in Singapore is the removal of late payment fees. However, you must have been consistently repaying your instalments for at least six months before your first late repayment. Standard Chartered CashOne Personal Loan’s interest rate starts at 2.88% p.a., putting it among the cheapest loans from banks in Singapore.

6. HSBC Personal Loan (Instalment Plan)

If you require a cheap loan with a long tenure, HSBC’s might just have the longest among Singapore’s banks. Furthermore, if you have an existing HSBC Personal Line of Credit, you don’t need to submit any supporting documents for your application. Its interest rate starts at 2.92% p.a., making this cheap loan in Singapore a competitive option for applicants.

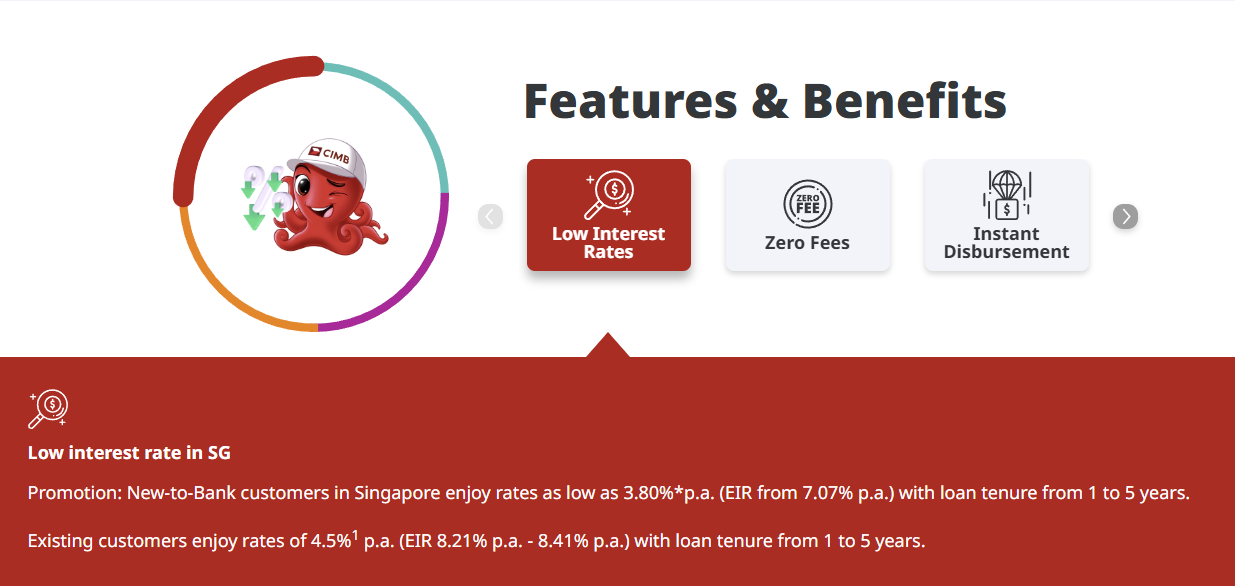

7. CIMB CashLite Personal Loan

This personal loan’s calling card is its low interest rate, starting at 2.8% p.a. In fact, it’s one of the cheapest loans in Singapore among the banks featured here. The CIMB Personal Loan’s interest loan is applied uniformly across all tenures and amounts, so you aren’t getting short changed if you apply for a lower tenure and/or amount.

8. GXS FlexiLoan

This cheap loan option is from a relatively new digital bank in Singapore, offering no fees at all and an interest rate starting at 2.88% p.a. If you receive a bonus at work or if an investment pays off early, you can settle your GXS FlexiLoan before its due date without incurring penalties. This isn’t a common feature for personal loans from banks in Singapore, making it the perfect short term loan if you can clear your loan repayments quickly!

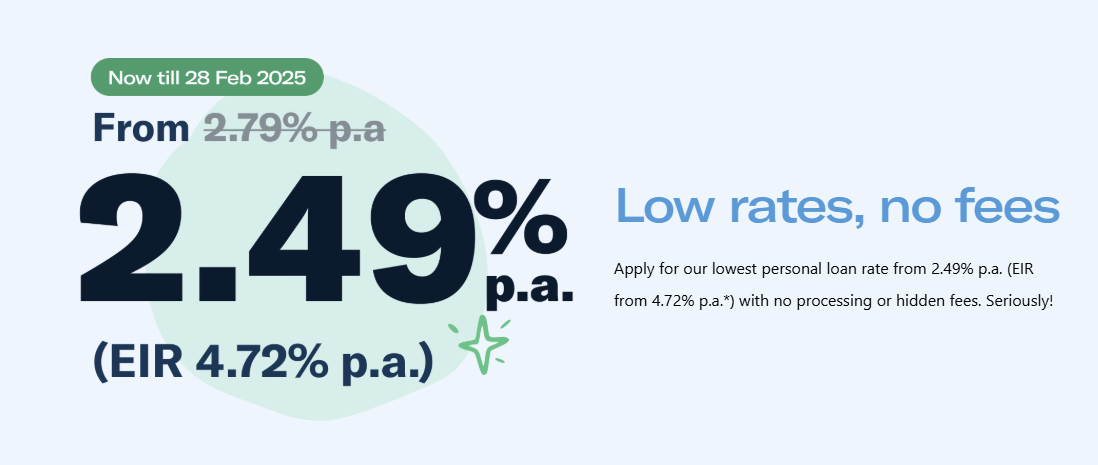

9. Trust Instant Loan

Trust is another relatively new digital bank in Singapore, and its Instant Loan sports a regular interest rate of 2.79% p.a. But make sure to watch out for limited offers from time to time as they’re always offering sweet deals! At this time of writing, they’re offering interest rates from 2.49% p.a. and EIR of 4.72% p.a., which makes it one of the cheapest loans in Singapore for sure. It has no hidden fees and boasts a loan tenure as short as three months long. This cheap interest loan advertises instant approvals and cash disbursements, but you need to have a Trust credit card first.

Are There Cheap Loan Providers Apart From Banks?

If you don’t qualify for cheap interest loans from banks in Singapore, consider the solutions that a licensed money lender has to offer. The industry is strictly regulated by the Ministry of Law, with firms like MM Credit being subject to stringent checks before being allowed to operate and continue operating. Rest assured that your cheap loan is a legitimate one.

Because there are 150+ licensed money lenders in Singapore, there’s greater potential for you to obtain the cheapest loans. Your credit score might affect your loan’s interest rate, but as long as you can prove your identity, income, and proof of residence in Singapore, you’ll be eligible for a licensed lender’s personal loan.

Whether it’s a 1 month loan or 12 month loan, a licensed lender offers a wide range of loan tenures with flexible loan repayments. At MM Credit, you can expect to get a loan amount of your choice (subject to approval and salary) and quick cash in 30 minutes. What makes it such a cheap loan is how rates are capped at 4% a month without any hidden fees or charges at all.

How Do You Choose the Cheapest Loan in Singapore?

As discussed above, selecting the cheapest loan from legitimate money lenders requires you to consider several points first:

- How much you really need to borrow

- How long would your loan tenure realistically be

- The loan’s effective interest rate

- Do you meet the loan’s eligibility criteria

Once you have these ironed out, you can start comparing between the different cheap loans available. And remember, the eligibility criteria for money lenders and banks differ. MM Credit is focused on your monthly income as a measure of your reliability as a borrower, so fret not if your credit score is poor. You will still be able to obtain a loan from us.

With that said, if you do have a good or excellent credit score, remember to submit it as part of your supporting documents. It might just lead to better interest rates or other perks.

Now that you’re more well-informed about the cheapest loan in Singapore, kickstart your application with MM Credit! An online application only takes seconds, and our loan executives will reach out to you with a personalised quote as soon as possible.

You can even select your preferred mode of funds disbursal once your cheap loan application is approved.