What can a personal loan for Grab drivers in Singapore be used for?

As its name suggests, a personal loan for Grab drivers in Singapore is a quick Grab finance loan designed for Grab drivers, no matter whether they’re new or experienced, young or old.

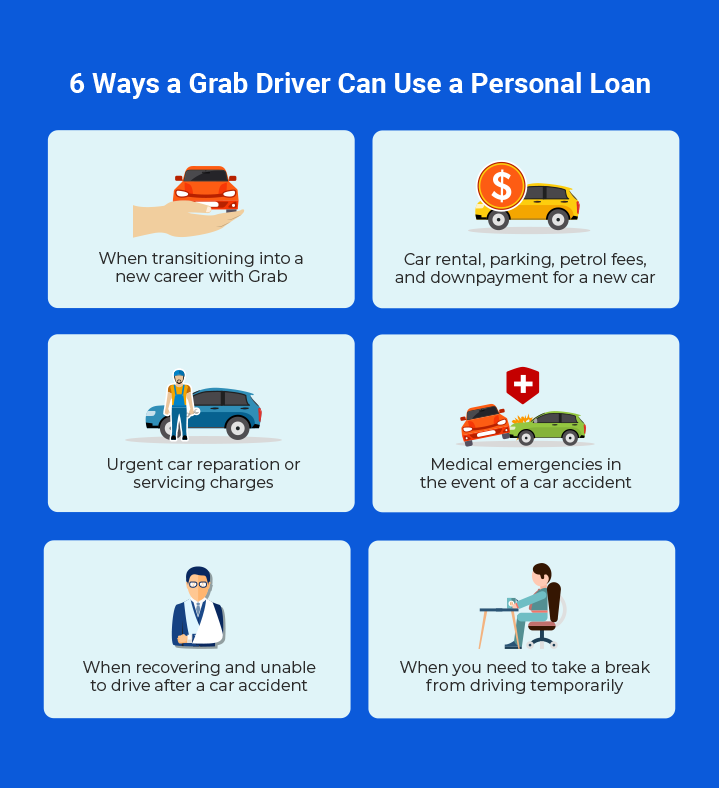

There are many ways in which Grab drivers can utilise a Grab loan. However, there is no hard and fast rule as to what they can use their Grab loan for — it is entirely up to Grab drivers to decide how they want to use their Grab loan.

The following six ways are several useful suggestions, especially for folks who are new to being a private hire driver.

1. When transitioning into a new career with Grab

A personal loan for Grab drivers in Singapore can supplement your income at the beginning when your salary from driving is still on the lower side. As with all jobs, it takes time to get into the groove of sticking with a new work routine and getting the hang of driving for long hours every day.

This particular loan is meant to tide you through this initial phase, helping you out with your cash flow and dealing with an added or even brand-new set of expenses.

2. Car rental, parking, petrol fees, and downpayment for a new car

Are you a Grab driver who doesn’t own your own vehicle? A Grab loan can come in handy when the time to make car rental payments rolls around and you find yourself short on cash. In such situations, having the ability to continue renting your car is crucial as it determines whether or not you can continue driving, and thus, earn a living.

Of course, you may also use part of your loan to pay for things like insurance charges, parking, and petrol fees. These are common costs that come with driving in Singapore and having a loan helps take some of the weight off your shoulders.

Are you buying a new car instead? You can use the funds from your Grab loan to pay the downpayment for your new car either partially or in full. Remember, you are the one deciding what to do with the funds disbursed from the Grab loan that you’ve taken on.

3. Urgent car reparation or servicing charges

All drivers should be prepared to deal with an urgent car reparation or servicing at some point in time. While that is certainly easier said than done, there are times when we simply do not have sufficient spare cash set aside for such purposes. This is where a Grab loan can shine, providing you with a source of emergency funds in the event anything goes awry.

4. Medical emergencies in the event of a car accident

Even if you have various health insurance plans in force, not everything is claimable all the time. In the unfortunate event of car accidents, Grab drivers who do not have enough savings to foot emergency medical bills can consider turning to personal loans for Grab drivers in Singapore.

This is especially useful if their family and friends aren’t able to help because of financial constraints on their end.

5. When recovering and unable to drive after a car accident

Extending from the point above, Grab drivers who have met with more serious car accidents may require an extended period away from work to recuperate.

For Grab drivers who are the sole breadwinners for their families, the financial burden stemming from their inability to work can be devastating for themselves and their loved ones. A personal loan for Grab drivers in Singapore can help alleviate the financial burden while they recover.

6. When you need to take a break from driving temporarily

A personal loan for Grab drivers in Singapore isn’t restricted to enabling Grab drivers to drive more and clock more hours. On the contrary, it is perfect for letting drivers take a break from driving, too. The extra cash in hand reduces the pressure on drivers and allows them to take a much-needed break and rest.

Individuals who have just started as Grab drivers will feel less stressed out as well, being able to compose themselves as they figure out this new occupation.

The interest rate for a personal loan for Grab drivers in Singapore

Licensed money lenders and banks do offer personal loans to Grab drivers and other self-employed individuals.

Licensed money lenders are allowed to charge a maximum monthly interest of 4%. However, the actual interest rate you’ll receive depends on the licensed money lender’s assessment of your financial capability and situation.

For the most part, borrowers of this loan type can choose either weekly or monthly repayments, whichever suits their needs better. This interest rate and repayment frequency is a boon for Grab drivers, who can cash out their earnings up to twice per 24-hour window.

That being said, ensure that you repay your loans on time, as with any other form of credit that you take on. Never let your loans snowball, especially when you can withdraw your daily earnings almost instantly. Use this flexibility to your advantage and make timely repayments.

How to qualify for a personal loan for Grab drivers in Singapore

To be eligible for a personal loan for Grab drivers in Singapore, you need to be at least 30 years old, a Singaporean, Singapore Permanent Resident, or a foreigner with a valid working permit. Of course, you must also be working as a private hire driver with Grab.

Apart from your NRIC, most licensed moneylenders require you to furnish your latest 3-month Grab statements when applying for your Grab loan. New Grab drivers can produce their latest 3-month payslips or CPF statements instead. Those who were previously self-employed need to show their past two years’ NOA.

MM Credit is a licensed money lender that offers Grab loans at an interest rate of 3.92% per month. Borrowers can choose either weekly or monthly repayments, whichever suits their needs better.

To apply for a Grab loan, simply submit an application via the Online Loan Form. Our experienced loan officers will reach out to you with a personalised loan quote that fits your needs and financial situation.

About the Author

As a premier professional lender that is focused on assisting customers with their unique loan needs since 2010, MM Credit regularly dishes out well-crafted content on loans and personal finance.