Being a freelance worker comes with many perks, like the freedom to set your own schedule. Two popular freelance jobs in Singapore are being a private hire vehicle driver or delivery rider for tech firm Grab. However, there might be cases where you’d need to know how to apply for a Grab loan.

That’s because freelancers don’t draw a fixed salary. A financial emergency may just occur when your income dips. If this happens, a Grab loan application provides you with the funds to get through your emergency.

However, what loans are available for Grab drivers and delivery riders? What sets them apart from a personal loan? Read on, because we’ve got the answers for you.

What are the types of Grab finance loans available?

1. Grab’s Partner Cash Advance

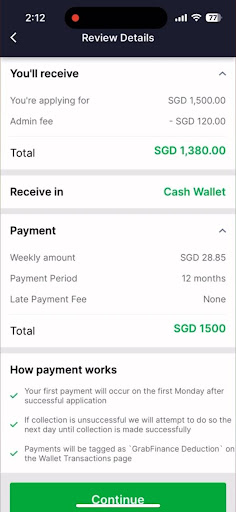

A typical cash advance is attractive because it’s usually approved quickly. This is what Grab’s Partner Cash Advance offers, helping eligible drivers and delivery riders swiftly access credit. Loans range from S$1,000 to S$10,000 and the tenures range from three to nine months.

The Partner Cash Advance has no interest or late fees. There’s only one processing fee of up to 2% per month, depending on the tenure and loan amount. This is equivalent to an 18% interest if the borrower is charged the maximum processing fee and selects the longest loan tenure, as divulged in the news report on Partner Cash Advance.

Lastly, repayments are done via automatic weekly deductions from the borrower’s Grab account. However, Grab decides who is eligible for this loan. Drivers and delivery riders can meet its requirements, like earning at least S$1,000 per month, but they might still not qualify for it.

2. GrabFinance Loan

Grab has merchant partners keeping its platform running, too. A GrabFinance loan helps them grow their business or ease their cash flow. When merchants make a Grab loan application, the most they can borrow is S$100,000.

As for the loan tenure, it ranges from three months to 12 months. Repayments are made daily, being automatically deducted from the merchant’s Grab account. However, these are adjusted according to their daily sales.

For example, if the merchant didn’t earn anything that day, no repayment is needed. Additionally, deductions are only made for the first 27 days of the month. Grab doesn’t charge interest for its GrabFinance loan, only a one-time fee deducted from the principal loan amount.

3. Licensed Money Lender’s Grab Loan

Another option for Grab drivers and delivery riders would be a licensed money lender loan. This comes in handy if you don’t qualify for Grab’s Partner Cash Advance. Fret not, licensed money lenders are regulated by the Ministry of Law.

A Grab loan from a licensed money lender is like a personal loan, where you’re disbursed a lump sum of money before repaying it monthly. The maximum amount you can borrow depends on your yearly income. If it’s below S$20,000, you can borrow up to S$3,000. If it’s at least S$20,000, you can borrow up to six times your monthly income.

Regarding interest rates, licensed money lenders can only charge a maximum of 4% per month. There are limits for other fees, too. For example, they can only levy a processing fee of up to 10% of the principal loan amount.

Lastly, loan tenures for a licensed money lender’s Grab loan range from one to 12 months. The shorter the loan tenure, the quicker you’ll be able to repay the loan. However, this is also provided that you are financially capable to repay during that short period.

If time is not on your side, consider a 12 month loan instead so you can repay in smaller loan instalments over a longer period of time.

How do I apply for a Grab loan?

Grab loan application for a Partner Cash Advance

Here’s the full eligibility criteria for Grab’s Partner Cash Advance. Remember, Grab makes the final call regarding whether to make this loan available to you:

- You’ve been driving or delivering for Grab for at least three months

- Your average monthly earnings are at least S$1,000

- You’ve been actively driving or delivering in the past week

- You’ve passed Grab’s internal credit risk assessments

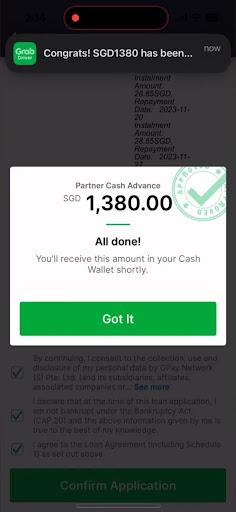

Applying for Grab’s Partner Cash Advance takes six steps. Also, this does not affect your earnings or incentives:

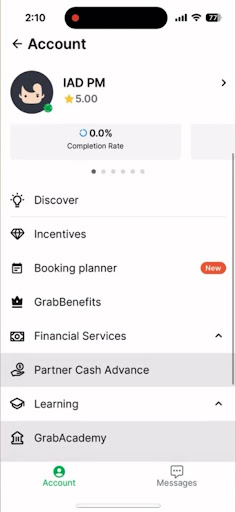

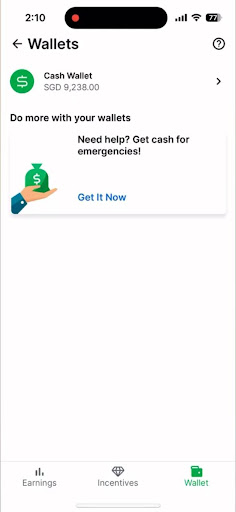

1. In the Grab Driver app, locate the Partner Cash Advance in either the Wallets or Account page.

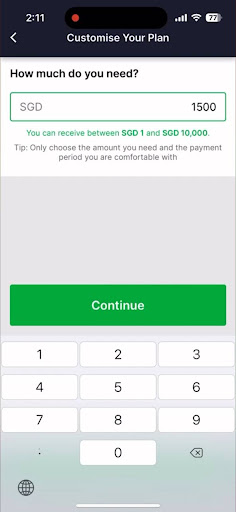

2. Enter how much you’d like to borrow.

3. Select your preferred loan tenure, ranging from three to nine months.

4. Review your loan’s details and tap “Continue”.

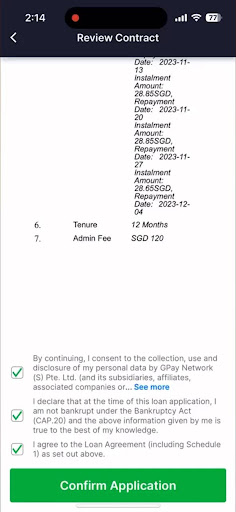

5. Review the loan agreement before tapping the checkboxes and “Confirm Application”.

6. You’ve applied for a Partner Cash Advance! You’ll be notified when the funds are disbursed to you.

Grab loan application for a GrabFinance Loan

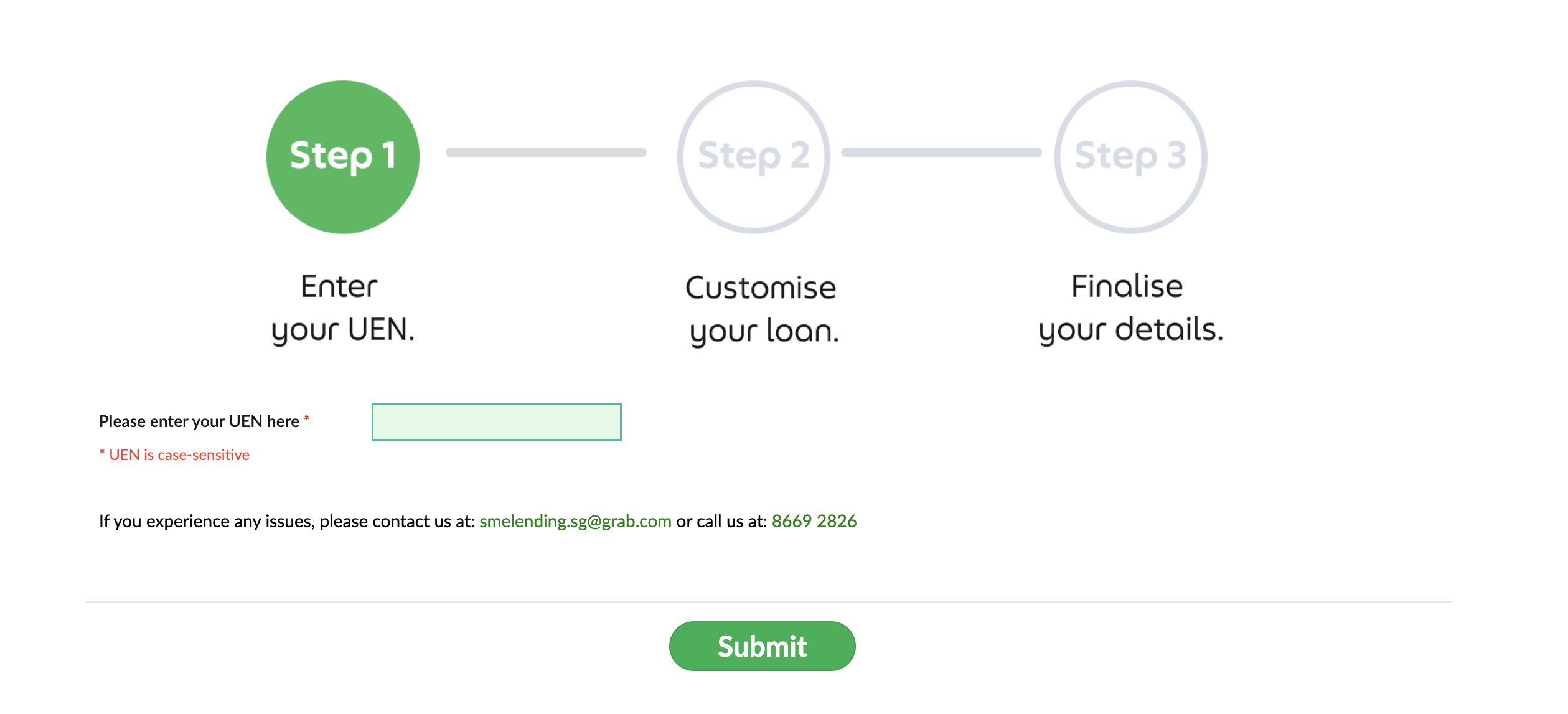

For merchant partners who wish to take up a GrabFinance loan, applying is as simple as visiting the GrabFinance Loan page. Then, enter your Unique Identity Number (UEN) and follow the onscreen instructions. When you’re customising your loan, ensure your business can meet the daily repayments.

After successfully applying for the GrabFinance loan, you’ll receive the funds within five business days. If you’re facing issues with your Grab loan application, reach out to the firm via the contact form on this page.

Don’t stretch your business too hard by taking on a loan that’s difficult to repay. Additionally, ensure your business expansion plan is sound, or that you have additional revenue after settling your company’s emergency.

Grab loan application for a licensed money lender’s Grab loan

Applying for a Grab loan from a licensed money lender is quick and easy. Furthermore, you won’t need to worry about your credit score determining if your application gets approved. Your ability to show you’re consistently generating an income is more important.

Here’s how to apply for a licensed money lender’s Grab loan:

1. Prepare your supporting documents:

- Identification proof (NRIC)

- Income proof (IRAS Notice of Assessment, monthly Grab account statements, bank statements, official income statements, etc.)

- Credit report (Optional, but recommended if you have a good credit score)

2. Send in your loan application online or at the licensed money lender’s business premise

3. Submit your supporting documents and wait for approval. Thereafter, you need to visit the licensed money lender’s office

4. Review the company’s loan offer alongside its loan executives. If you’re not satisfied with its terms, you can reject it. No payment is needed as you haven’t signed an agreement yet

5. If you’re satisfied, sign the loan offer. The funds will be disbursed to your bank account or handed to you in cash

Reminder: The maximum loan amount depends almost entirely on your yearly income. You need to earn at least S$20,000 annually if you wish to borrow up to six times your monthly income.

Which Grab loan application should you go for?

| Grab’s Partner Cash Advance | GrabFinance Loan | Licensed Money Lender’s Grab Loan | |

| Loan Amount | Up to S$10,000 | Up to S$100,000 | Up to 12 times your monthly income |

| Loan Tenure | 3-9 months | 3-12 months | 1-12 months |

| Interest Rate | None | None | Up to 4% per month |

| Other Fees & Charges | – One-time processing fee of up to 2% per month | – One-time processing fee that’s pegged against your principal loan amount | – One-time processing fee of up to 10% of the principal loan amount

– Late repayment fee that does not exceed S$60 for every month the loan instalment is repaid late – Late interest of up to 4% per month |

Now that you know how to apply for a Grab loan, you need to decide which option is best. If you’re a merchant partner, a GrabFinance Loan is ideal. However, if Grab’s option doesn’t cut it, you might want to approach a licensed money lender and enquire about its business loans.

For Grab drivers and delivery riders, the Partner Cash Advance is a no-brainer. There are no interest fees and repayments are automatically done. However, not everyone is eligible. Furthermore, Grab regularly updates its list of eligible drivers and delivery riders.

You might be able to apply for it this month, but it may disappear the next. This is where a licensed money lender’s Grab loan comes in handy.

In closing

Grab’s gig workers and merchant partners have a solution if they need cash urgently. If all else fails, Grab drivers, delivery riders, and even merchant partners can turn to a licensed money lender.

One licensed and credible money lender is MM Credit. We’ve been operating in Singapore since 2010 and you can start your Grab loan application conveniently on our website round the clock. Our experienced and friendly loan officers will reach out to you with a personalised quote in no time.

There’s no need to fret if you don’t qualify for Grab’s financial services. We’ve got you covered!

*All Grab screenshots are credited to Grab

About the Author

Personal finance and geek culture are his passions, although the latter threatens to wreck his savings goal every month.