The Ideal Renovation Loan for Your Dream Home Makeover

Revamping an entire home can deplete your savings, but it doesn’t have to be the case with a home renovation loan in Singapore.

MM Credit’s reno loan is one of the best deals around that lets you build your dream home.

Get your home makeover going with our renovation loan!

Why Should MM Credit Be Your Renovation Loan Money Lender?

Speedy Loan Process and Approval

Get your renovation loan application approved in as fast as 30 minutes.

Attractive interest rates

Interest rates for our home renovation loan in Singapore never exceed 4% a month.

Flexible repayment schedules

Our renovation loans come with customised repayment plans — choose from a range of tenures and loan amounts for your reno loan in Singapore.

Monthly Repayments Made Fuss-Free

Our home renovation loan in Singapore turns one large cost into regular smaller repayments.

Flexible repayment schedules

Our renovation loans come with customised repayment plans — choose from a range of tenures and loan amounts for your reno loan in Singapore.

Monthly repayments made fuss-free

Our home renovation loan in Singapore turns one large cost into regular smaller repayments.

Complete transparency

Our renovation loans don’t come with any hidden charges or clauses. All fees will be said upfront.

Minimal eligibility requirements

From lower annual income eligibility to less stringent credit checks, the chances of getting a renovation loan approved is much higher as compared to other loan providers.

What Is a Renovation Loan in Singapore?

A renovation loan is a personal loan that’s unsecured, which means you don’t need to put down collateral for it. A renovation loan’s funds are only meant for your home makeover, such as reconfiguration, repairs, electrical works, and flooring. The borrowing limits and tenures for a renovation loan in Singapore are generally identical to a personal loan’s.

How Does a Home Renovation Loan in Singapore Work?

A renovation loan in Singapore works like a personal loan, where you borrow a sum of money and repay it in equal amounts every month until the tenure is over. We may conduct a post disbursement site visit to ensure you’re using the renovation loan’s funds for your home makeover.

Top Uses for a Renovation Loan in Singapore

Extensive Home Repairs

If existing fittings, pipes, and large appliances need to be repaired, the bill can be hefty. A reno loan in Singapore takes the sting away while enabling you to get everything at home back to tip top shape.

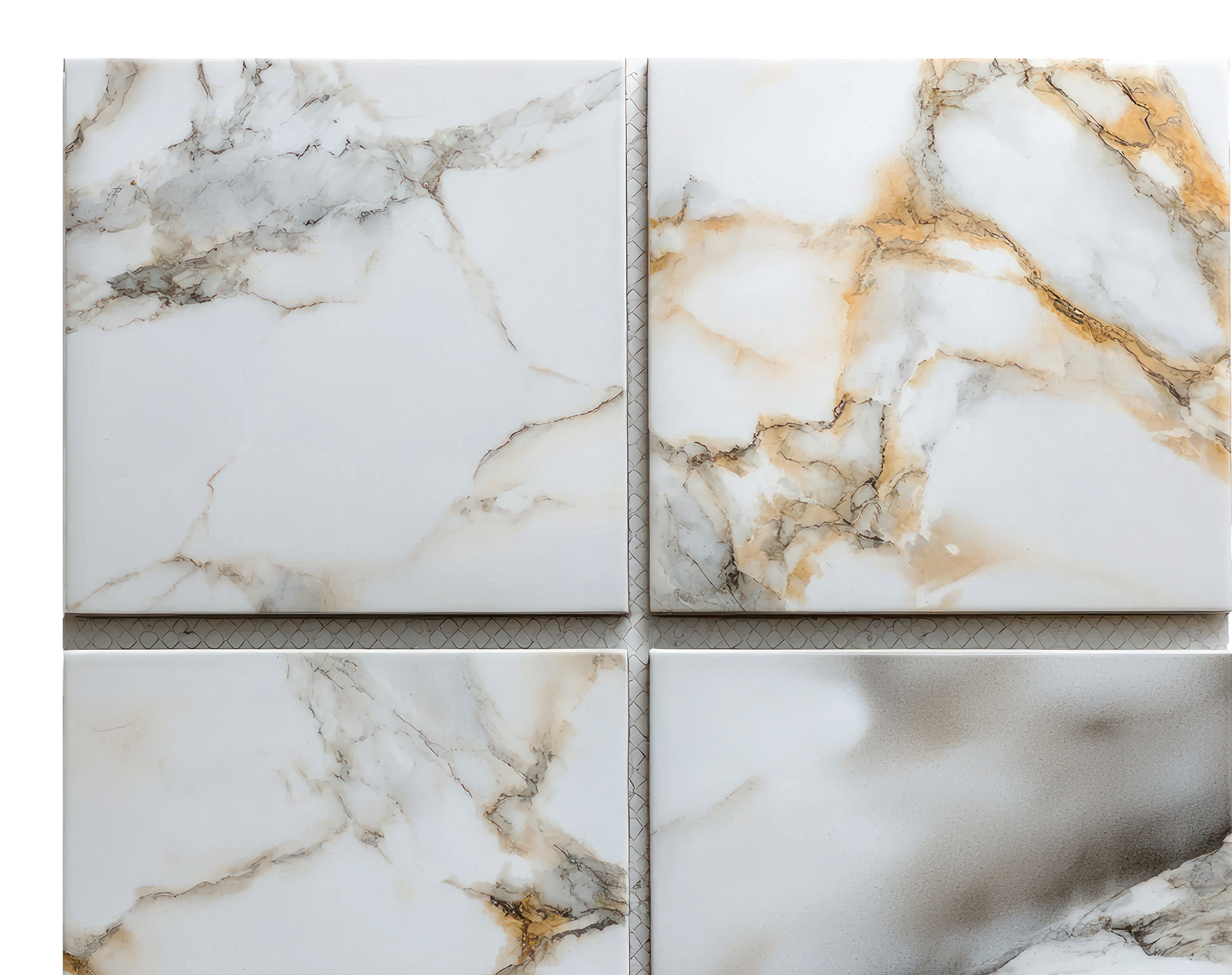

Flooring and Tiles

If your home’s flooring is no longer up to scratch, use a renovation loan to fund a replacement. All flooring and tiles are covered under a renovation loan in Singapore.

Electrical Works

Although the cost is high, this is something you’d want a certified company to handle. Let your reno loan cover the bill that comes from a proper wiring job and electrical works.

Bathroom Fixtures

A reno loan in Singapore covers the purchase and installation of bathroom fixtures. These include the usual suspects of a shower and toilet. If there’s anything else you’d like to install, the reno loan covers it, too.

Painting

A new coat of paint instantly refreshes the look of your home. Whether you’re doing it yourself by purchasing paint and equipment or hiring a company, a renovation loan covers the cost.

Carpentry

Built-in furniture and storage can cost a pretty penny, but save you a ton of space while beautifying your home. A renovation loan shoulders the bill for you, across both the labour and material costs.

Furniture

Renovation loans from banks don’t cover furniture costs. However, MM Credit’s renovation loan does not exclude any furniture you’re purchasing for your home, such as a bed and sofa.

Apply for Your Renovation Loan in 3 Easy Steps

1

Submit your renovation loan application

Submit your renovation loan application online or in-person, alongside your supporting documents.

2

Receive application status

Be notified of your reno loan application status in 30 minutes.

3

Get your cash disbursement

Head down to MM Credit’s office to review your reno loan offer, sign the contract, and we’ll disburse your cash in a jiffy!

Your dream home is only a click away! Let our renovation loan help with funding, while you worry about designing.

Frequently Asked Questions: Home Renovation Loans in Singapore

1 How much do home renovations cost in 2025?

This depends on your home and how extensive your remodelling is. For example, renovating a 3-room HDB flat costs between S$36,000 and S$62,000. Renovations for a 5-room HDB flat can easily hit S$100,000. That’s why many need a reliable renovation loan to shoulder some of the upfront costs.

2What should I look out for when selecting a renovation loan?

Choosing the ideal renovation loan in Singapore requires you to look out for these key factors:

- A low monthly interest rate

- A tenure you’re comfortable with

- A processing fee below 10% of the principal loan amount

3Can I take up a renovation loan in Singapore without pledging any collateral?

A renovation loan in Singapore is an unsecured loan by default. There’s no need to pledge collateral for your renovation loan unless you need an amount beyond the limit based on your annual income.

4Can I get my home renovation loan approved on the day I applied for it?

Definitely! Approvals are usually faster when all the details in your renovation loan application form are filled in accurately and you’ve included all supporting documents.

5Is MM Credit’s renovation loan legal?

Yes, because MM Credit is a licensed money lender registered with Singapore’s Ministry of Law. Not only are our renovation loans legal, but our suite of personal and business loans, too.

6What’s the loan tenure of MM Credit’s renovation loan in Singapore?

We generally disburse renovation loans of up to 12 months long, but speak with us if you require a longer tenure.

7What’s the interest rate of MM Credit’s home renovation loan in Singapore?

Our renovation loans have among the best interest rates in Singapore, never exceeding 4% a month.

8Are there any late repayment fees for my home renovation loan?

If you repay your renovation loan late, you’ll be charged two fees:

- An additional interest of up to 4% for every month you repay the renovation loan instalment late

- A late penalty fee of up to S$60 per month the renovation loan instalment is paid late

9Can I use a personal loan in place of a home renovation loan in Singapore?

You can. However, a personal loan may or may not have lower interest rates than a renovation loan in Singapore. That being said, there are no restrictions on what you can use a personal loan for, as compared to a renovation loan.